Are you looking to break into the world of tax preparation? Our Tax Preparer Cover Letter Guide can help you get started. Learn how to craft a professional and effective cover letter that will make you stand out from the competition and show you have the skills and experience to be the best candidate for the job.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder.

- What a cover letter template is, and why you should use it.

Related Cover Letter Examples

- Audit Director Cover Letter Sample

- Private Banker Cover Letter Sample

- Financial Administrator Cover Letter Sample

- Mortgage Loan Officer Cover Letter Sample

- Tax Professional Cover Letter Sample

- Payroll Processor Cover Letter Sample

- Financial Aid Officer Cover Letter Sample

- Senior Financial Analyst Cover Letter Sample

- Credit Specialist Cover Letter Sample

- Accounting Associate Cover Letter Sample

- General Ledger Accountant Cover Letter Sample

- Loan Analyst Cover Letter Sample

- Accounting Assistant Cover Letter Sample

- Lead Auditor Cover Letter Sample

- Financial Business Analyst Cover Letter Sample

- Financial Consultant Cover Letter Sample

- Finance Officer Cover Letter Sample

- Portfolio Analyst Cover Letter Sample

- Experienced Real Estate Agent Cover Letter Sample

- Mortgage Banker Cover Letter Sample

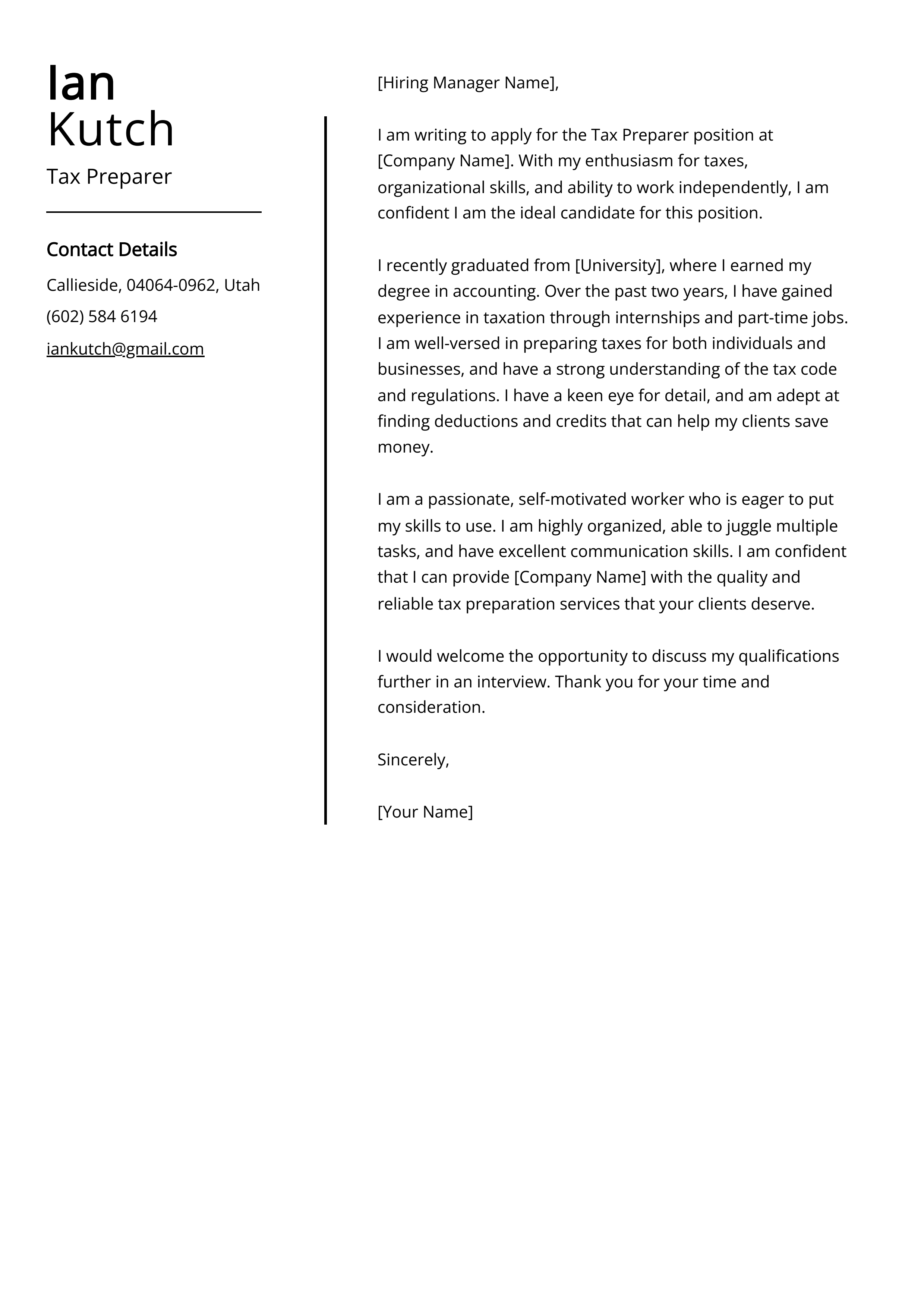

Tax Preparer Cover Letter Sample

Dear Hiring Manager,

I am writing in response to your advertisement for a Tax Preparer on Indeed.com. With my extensive experience in tax preparation, I am confident that I can exceed your expectations in this role.

I have seven years of experience in preparing taxes for individuals and small businesses. I have a Bachelor of Science degree in Accounting from the University of Maryland, and I am a Certified Public Accountant (CPA). I am also an Enrolled Agent with the Internal Revenue Service.

I have a proven track record of success in tax preparation. I have saved my clients thousands of dollars in taxes by finding deductions and credits they were unaware of. I have also assisted in the preparation of complex returns, including those for trusts and estates. I pride myself on accuracy and timeliness. I am detail-oriented and have a knack for finding errors in tax returns.

I am proficient in the use of tax preparation software, such as TurboTax and H&R Block. I am also familiar with QuickBooks and other bookkeeping programs. I stay current on all changes in the tax code and am knowledgeable about the latest tax laws.

I am a reliable and hardworking individual who is dedicated to providing outstanding customer service. I have excellent communication and interpersonal skills and have the ability to explain complex tax concepts in a clear and concise manner.

I am confident that I am the best candidate for the Tax Preparer position and I am eager to put my skills and experience to work for your company. I am available for an interview at your convenience and I look forward to discussing this position with you further.

Thank you for your time and consideration.

Sincerely,

Your Name

Why Do you Need a Tax Preparer Cover Letter?

- A Tax Preparer cover letter is an important part of the job application process and can help you stand out from the competition.

- It provides an opportunity for you to highlight your qualifications and experience, and to show potential employers why you are the best candidate for the job.

- Your cover letter should demonstrate your knowledge of the tax preparation field, as well as your enthusiasm and commitment to the job.

- It should also showcase your ability to communicate effectively and your attention to detail.

- Finally, a Tax Preparer cover letter will help you stand out from the competition and give you an edge in the job search.

A Few Important Rules To Keep In Mind

- Start the letter with a polite greeting and the name of the hiring manager.

- Briefly introduce yourself in the opening paragraph.

- Explain why you are the perfect candidate for the position in the second paragraph.

- Highlight your qualifications and experience in the third paragraph.

- Close by expressing your enthusiasm for the role and thanking the hiring manager for their time.

- Proofread the letter before sending it.

- Include your contact information at the end of the letter.

- Keep the letter concise and to the point.

- Avoid using any cliches or overused phrases.

- Personalize the letter to the company and position.

- Focus on your unique skills and experience that make you the best candidate for the job.

What's The Best Structure For Tax Preparer Cover Letters?

After creating an impressive Tax Preparer resume, the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Tax Preparer cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Tax Preparer Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

Dear [Tax Preparer Hiring Manager],

I am writing to apply for the position of Tax Preparer at [company name]. I am confident that my experience and qualifications make me an ideal candidate for the job.

I have a Bachelor's Degree in Accounting and have over five years of experience as a Tax Preparer. In my current role, I prepare tax returns for individuals and businesses. I utilize various software programs such as TaxSlayer and TaxAct to ensure accuracy and compliance with federal and state regulations. Additionally, I have a thorough understanding of the tax code and am knowledgeable on the latest changes and amendments.

My attention to detail, ability to work under pressure, and communication skills are essential in my current role and will be an asset to your team. I take pride in providing clients with accurate, timely, and transparent tax returns. I am also comfortable managing multiple clients at once and I always ensure deadlines are met.

I am passionate about working as a Tax Preparer and I am excited for the opportunity to work with your team. I would love to discuss my experience and qualifications further in an interview. I sincerely look forward to hearing from you.

Sincerely,

[Your Name]

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Tax Preparer Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Failing to target the letter to the employer or position

- Using an inappropriate greeting

- Including irrelevant information

- Not proofreading the cover letter for typos and errors

- Neglecting to explain how your skills and experience are a good fit for the position

- Using overly complex or flowery language

- Not following the instructions provided in the job listing

- Exceeding one page in length

- Skipping the cover letter altogether

- Using a generic cover letter for multiple applications

Key Takeaways For a Tax Preparer Cover Letter

- Highlight any relevant experience you have in tax preparation.

- Explain why you are interested in the position and why you would be a good fit.

- Show your knowledge of the latest tax laws and regulations.

- Describe your ability to work independently and as part of a team.

- Mention any specific software or tools you are familiar with.

- Demonstrate your excellent organizational and time-management skills.

- Express your enthusiasm for helping clients with their tax-related needs.

It's time to begin the job search. Make sure you put your best foot forward and land your next postal service job with the help of Resumaker.ai.