As a life insurance agent, it is crucial to have a compelling cover letter to showcase your skills and experience to potential employers. A well-crafted cover letter can make a big difference in getting noticed and landing an interview. In this guide, we will provide you with tips and examples to help you create a strong cover letter that sets you apart in the competitive field of life insurance sales.

We will cover:

- How to write a cover letter, no matter your industry or job title.

- What to put on a cover letter to stand out.

- The top skills employers from every industry want to see.

- How to build a cover letter fast with our professional Cover Letter Builder.

- Why you should use a cover letter template

Related Cover Letter Examples

- Blood Bank Technologist Cover Letter Sample

- Ct Technologist Cover Letter Sample

- Health Unit Coordinator Cover Letter Sample

- Clinical Trial Manager Cover Letter Sample

- Hospice Nurse Cover Letter Sample

- Certified Pharmacy Technician Cover Letter Sample

- Geriatric Nursing Assistant Cover Letter Sample

- Direct Care Worker Cover Letter Sample

- Behavioral Health Technician Cover Letter Sample

- Patient Access Manager Cover Letter Sample

- Ekg Technician Cover Letter Sample

- Patient Care Technician Cover Letter Sample

- Patient Sitter Cover Letter Sample

- Mds Coordinator Cover Letter Sample

- Biostatistician Cover Letter Sample

- Medical Engineer Cover Letter Sample

- Certified Home Health Aide Cover Letter Sample

- Nurse Aide Cover Letter Sample

- Clinical Social Worker Cover Letter Sample

- Outpatient Therapist Cover Letter Sample

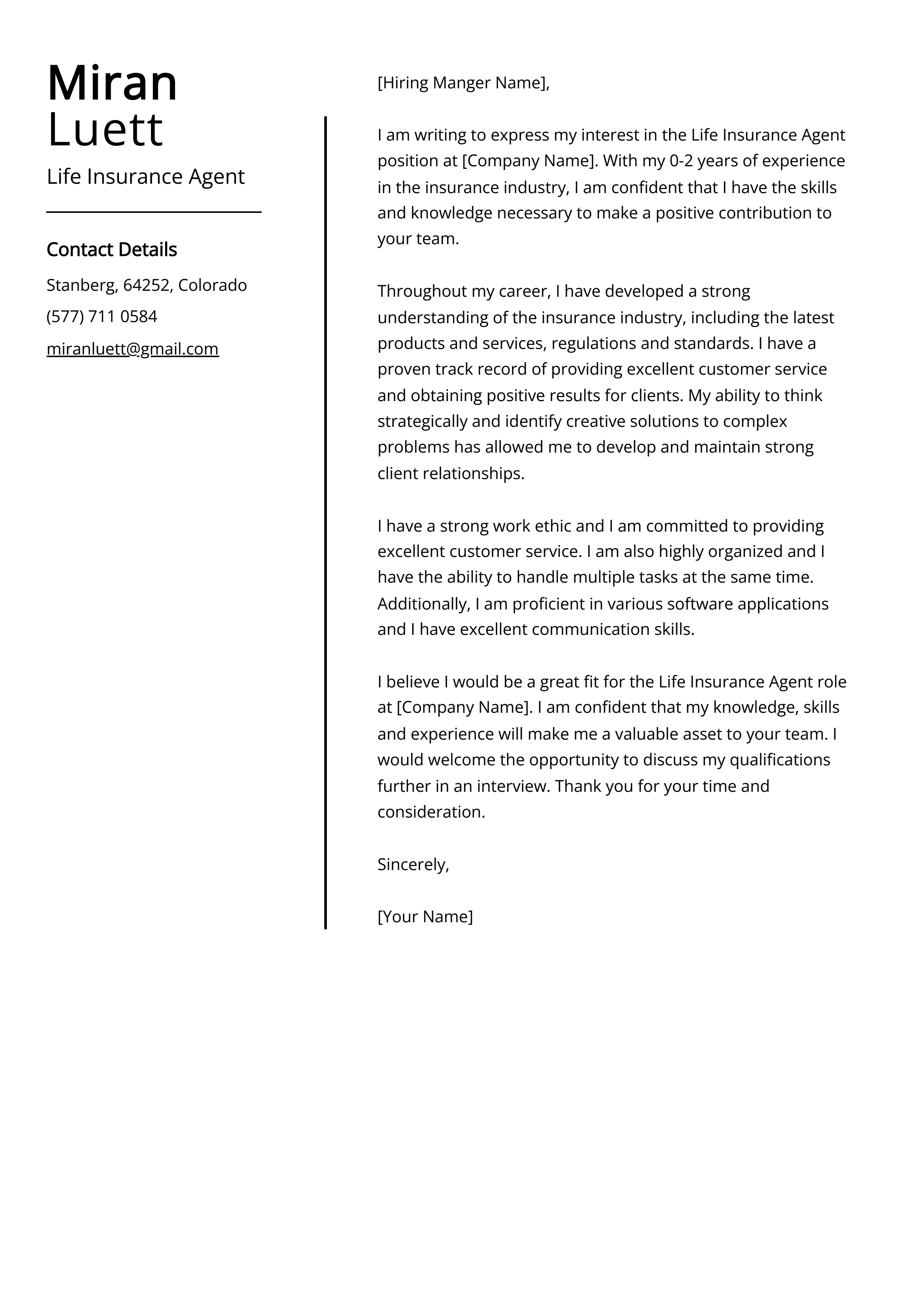

Life Insurance Agent Cover Letter Sample

Dear Hiring Manager,

I am writing to express my interest in the Life Insurance Agent position at your esteemed company. With over 5 years of experience in the insurance industry, I am confident in my ability to contribute to your team and help clients secure the best coverage for their needs.

In my previous role as a Life Insurance Agent, I was responsible for prospecting new clients, conducting thorough needs assessments, and presenting comprehensive insurance solutions tailored to each client's unique situation. I consistently exceeded sales targets and received positive feedback from satisfied clients. I am passionate about helping people protect their families and assets and strive to provide exceptional customer service in every interaction.

I am skilled in building and maintaining strong client relationships, educating clients on available coverage options, and simplifying complex insurance jargon into easily understandable terms. I am proficient in leveraging various communication channels, including phone, email, and in-person meetings, to effectively connect with clients and address their insurance needs.

Additionally, I am well-versed in underwriting guidelines, policy analysis, and industry regulations, allowing me to confidently navigate the insurance landscape and guide clients toward the most suitable life insurance options. I am also proficient in utilizing CRM systems and other technology tools to streamline processes and enhance productivity.

I am attracted to the opportunity to join your company due to your strong reputation for providing top-notch insurance solutions and dedication to client satisfaction. I am confident that my proven track record and dedication to excellence make me an ideal candidate for this role.

I am enthusiastic about the possibility of bringing my unique blend of skills and experience to your team and contributing to your continued success. Thank you for considering my application. I am looking forward to the opportunity to further discuss how I can contribute to your company.

Sincerely,

[Your Name]

Why Do you Need a Life Insurance Agent Cover Letter?

- Stand out from the competition: A well-written cover letter can help you stand out from other candidates by showcasing your unique skills and experiences.

- Highlight your passion for the industry: A cover letter allows you to express your passion for the life insurance industry and your desire to help clients protect their loved ones.

- Showcase your communication skills: A cover letter gives you the opportunity to demonstrate your written communication skills, which are essential in the insurance industry.

- Personalize your application: Including a cover letter allows you to tailor your application to the specific company and position, showing that you've done your research and are genuinely interested in the opportunity.

- Explain any career gaps or transitions: If you have any gaps in your work history or are transitioning from a different industry, a cover letter gives you the chance to explain these circumstances and emphasize how they have prepared you for the role of a life insurance agent.

A Few Important Rules To Keep In Mind

- Include a professional greeting and address the hiring manager by name if possible. For example, "Dear Mr. Smith,"

- Start by stating your interest in the Life Insurance Agent position and where you came across the job opening, whether it was through a job posting, referral, or networking.

- Highlight your relevant experience and qualifications, including your insurance certifications, sales experience, and knowledge of different insurance products.

- Showcase your excellent communication skills and ability to build rapport with clients, as well as your track record of meeting or exceeding sales targets.

- Express your enthusiasm for the opportunity to work for the company and your commitment to helping clients protect their financial futures through life insurance.

- Thank the hiring manager for considering your application and express your eagerness to discuss how you can contribute to the team in more detail during an interview.

- Close the cover letter with a professional sign-off, such as "Sincerely" or "Best regards," followed by your full name and contact information.

What's The Best Structure For Life Insurance Agent Cover Letters?

After creating an impressive Life Insurance Agent resume, the next step is crafting a compelling cover letter to accompany your job applications. It's essential to remember that your cover letter should maintain a formal tone and follow a recommended structure. But what exactly does this structure entail, and what key elements should be included in a Life Insurance Agent cover letter? Let's explore the guidelines and components that will make your cover letter stand out.

Key Components For Life Insurance Agent Cover Letters:

- Your contact information, including the date of writing

- The recipient's details, such as the company's name and the name of the addressee

- A professional greeting or salutation, like "Dear Mr. Levi,"

- An attention-grabbing opening statement to captivate the reader's interest

- A concise paragraph explaining why you are an excellent fit for the role

- Another paragraph highlighting why the position aligns with your career goals and aspirations

- A closing statement that reinforces your enthusiasm and suitability for the role

- A complimentary closing, such as "Regards" or "Sincerely," followed by your name

- An optional postscript (P.S.) to add a brief, impactful note or mention any additional relevant information.

Cover Letter Header

A header in a cover letter should typically include the following information:

- Your Full Name: Begin with your first and last name, written in a clear and legible format.

- Contact Information: Include your phone number, email address, and optionally, your mailing address. Providing multiple methods of contact ensures that the hiring manager can reach you easily.

- Date: Add the date on which you are writing the cover letter. This helps establish the timeline of your application.

It's important to place the header at the top of the cover letter, aligning it to the left or center of the page. This ensures that the reader can quickly identify your contact details and know when the cover letter was written.

Cover Letter Greeting / Salutation

A greeting in a cover letter should contain the following elements:

- Personalized Salutation: Address the hiring manager or the specific recipient of the cover letter by their name. If the name is not mentioned in the job posting or you are unsure about the recipient's name, it's acceptable to use a general salutation such as "Dear Hiring Manager" or "Dear [Company Name] Recruiting Team."

- Professional Tone: Maintain a formal and respectful tone throughout the greeting. Avoid using overly casual language or informal expressions.

- Correct Spelling and Title: Double-check the spelling of the recipient's name and ensure that you use the appropriate title (e.g., Mr., Ms., Dr., or Professor) if applicable. This shows attention to detail and professionalism.

For example, a suitable greeting could be "Dear Ms. Johnson," or "Dear Hiring Manager," depending on the information available. It's important to tailor the greeting to the specific recipient to create a personalized and professional tone for your cover letter.

Cover Letter Introduction

An introduction for a cover letter should capture the reader's attention and provide a brief overview of your background and interest in the position. Here's how an effective introduction should look:

- Opening Statement: Start with a strong opening sentence that immediately grabs the reader's attention. Consider mentioning your enthusiasm for the job opportunity or any specific aspect of the company or organization that sparked your interest.

- Brief Introduction: Provide a concise introduction of yourself and mention the specific position you are applying for. Include any relevant background information, such as your current role, educational background, or notable achievements that are directly related to the position.

- Connection to the Company: Demonstrate your knowledge of the company or organization and establish a connection between your skills and experiences with their mission, values, or industry. Showcasing your understanding and alignment with their goals helps to emphasize your fit for the role.

- Engaging Hook: Consider including a compelling sentence or two that highlights your unique selling points or key qualifications that make you stand out from other candidates. This can be a specific accomplishment, a relevant skill, or an experience that demonstrates your value as a potential employee.

- Transition to the Body: Conclude the introduction by smoothly transitioning to the main body of the cover letter, where you will provide more detailed information about your qualifications, experiences, and how they align with the requirements of the position.

By following these guidelines, your cover letter introduction will make a strong first impression and set the stage for the rest of your application.

Cover Letter Body

Dear Hiring Manager,

I am writing to express my strong interest in the Life Insurance Agent position at your company. With a background in sales and a passion for helping individuals and families protect their financial future, I believe that I would be a valuable addition to your team.

- Introduction: Begin by introducing yourself and stating the purpose of your letter. Express your interest in the Life Insurance Agent position and mention where you found the job posting.

- Sales Experience: Highlight any relevant sales experience or expertise you have, emphasizing your ability to effectively communicate the benefits of life insurance to potential clients. Provide specific examples or achievements that demonstrate your success in sales.

- Customer Service Skills: Discuss your ability to build and maintain strong relationships with clients, providing exceptional customer service and support throughout the insurance purchasing process.

- Knowledge of Insurance Products: Explain your familiarity with life insurance products and your ability to educate clients on their options, helping them make informed decisions that align with their individual needs and financial goals.

- Licensing and Certifications: If applicable, mention any relevant licenses or certifications you hold, demonstrating your commitment to professional development and compliance with industry regulations.

- Closing: Express your enthusiasm for the opportunity to contribute to the success of the company and request the opportunity to discuss how your skills and experience align with the needs of the Life Insurance Agent role in more detail during an interview.

Thank you for considering my application. I am eager to bring my passion for sales and dedication to helping others to your team. I look forward to the possibility of contributing to your company's continued success as a Life Insurance Agent.

Sincerely, [Your Name]

Complimentary Close

The conclusion and signature of a cover letter provide a final opportunity to leave a positive impression and invite further action. Here's how the conclusion and signature of a cover letter should look:

- Summary of Interest: In the conclusion paragraph, summarize your interest in the position and reiterate your enthusiasm for the opportunity to contribute to the organization or school. Emphasize the value you can bring to the role and briefly mention your key qualifications or unique selling points.

- Appreciation and Gratitude: Express appreciation for the reader's time and consideration in reviewing your application. Thank them for the opportunity to be considered for the position and acknowledge any additional materials or documents you have included, such as references or a portfolio.

- Call to Action: Conclude the cover letter with a clear call to action. Indicate your availability for an interview or express your interest in discussing the opportunity further. Encourage the reader to contact you to schedule a meeting or provide any additional information they may require.

- Complimentary Closing: Choose a professional and appropriate complimentary closing to end your cover letter, such as "Sincerely," "Best Regards," or "Thank you." Ensure the closing reflects the overall tone and formality of the letter.

- Signature: Below the complimentary closing, leave space for your handwritten signature. Sign your name in ink using a legible and professional style. If you are submitting a digital or typed cover letter, you can simply type your full name.

- Typed Name: Beneath your signature, type your full name in a clear and readable font. This allows for easy identification and ensures clarity in case the handwritten signature is not clear.

Common Mistakes to Avoid When Writing a Life Insurance Agent Cover Letter

When crafting a cover letter, it's essential to present yourself in the best possible light to potential employers. However, there are common mistakes that can hinder your chances of making a strong impression. By being aware of these pitfalls and avoiding them, you can ensure that your cover letter effectively highlights your qualifications and stands out from the competition. In this article, we will explore some of the most common mistakes to avoid when writing a cover letter, providing you with valuable insights and practical tips to help you create a compelling and impactful introduction that captures the attention of hiring managers. Whether you're a seasoned professional or just starting your career journey, understanding these mistakes will greatly enhance your chances of success in the job application process. So, let's dive in and discover how to steer clear of these common missteps and create a standout cover letter that gets you noticed by potential employers.

- Avoid using generic and vague language that doesn't highlight your specific qualifications and experiences.

- Avoid making the cover letter too long or too short. Aim for a balance that effectively communicates your skills and passion for the role.

- Avoid including irrelevant information or unnecessary details that do not directly relate to the position.

- Avoid using a one-size-fits-all approach. Tailor your cover letter to each specific job and company you are applying to.

- Avoid making spelling and grammatical errors. Proofread your cover letter multiple times before submitting it.

- Avoid focusing solely on what the company can do for you. Instead, emphasize what you can bring to the company and how you can contribute to its success.

Key Takeaways For a Life Insurance Agent Cover Letter

- Strong sales and communication skills

- Proven track record of meeting and exceeding sales targets

- Extensive knowledge of various life insurance products

- Ability to build and maintain strong client relationships

- Excellent organizational and time management skills

- Detail-oriented and able to analyze and understand complex insurance policies

- Flexibility and adaptability in a fast-paced, changing environment

- Proficient in utilizing technology and CRM systems to manage client information

It's time to begin the job search. Make sure you put your best foot forward and land your next job with the help of Resumaker.ai.